external debt borrowing, the relatively high ranking of Taiwan's sovereign rating is

an important indicator of the government's good standing and credibility. Taiwan's

high credit ranking undoubtedly enhance its fiscal space.

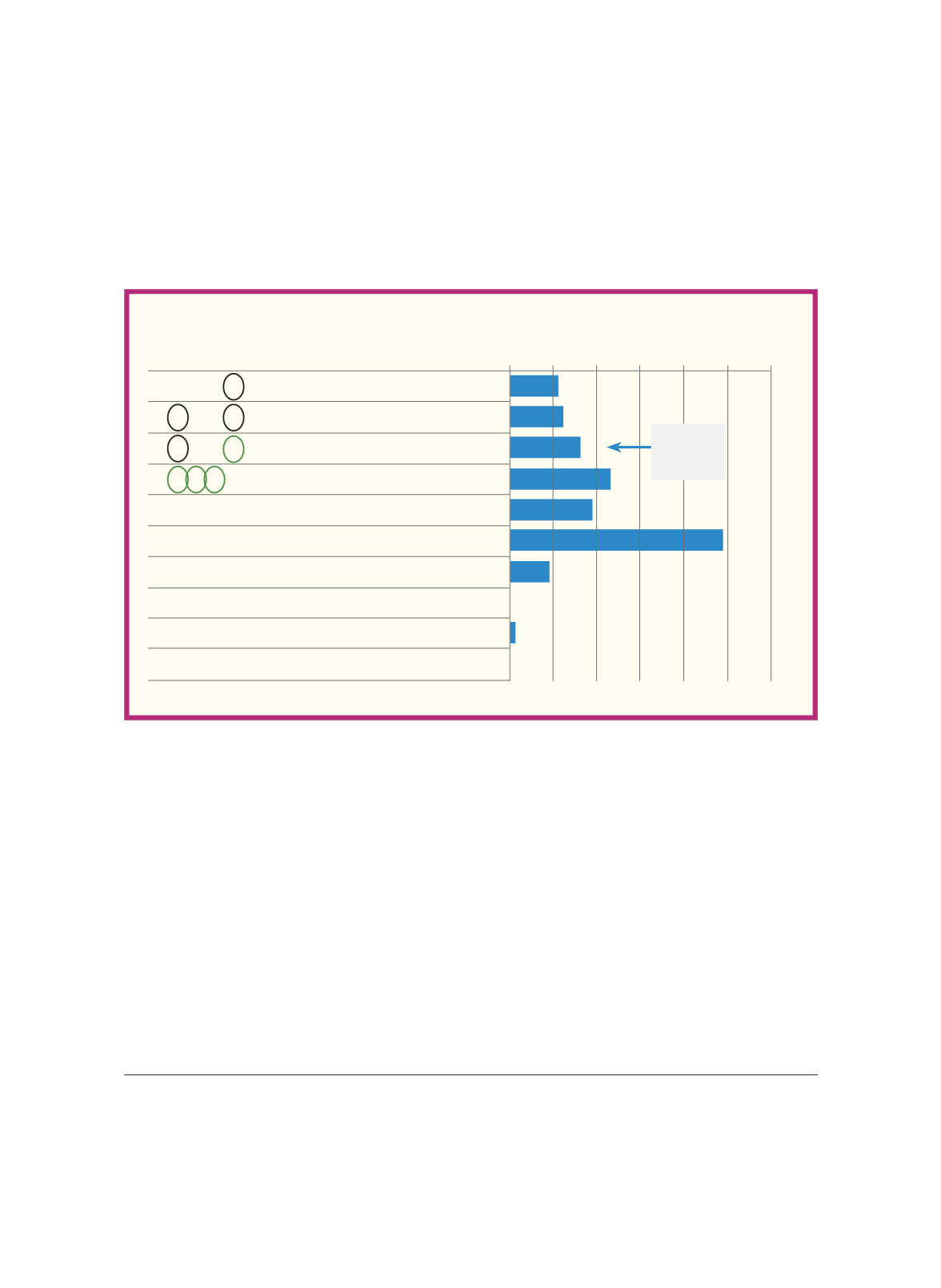

Sources: Expansion (2016). Figure drawn by the author. Also see Appendix C1.

Figure 7 Sovereign Credit Rating

Average of Moody's, S&P, and Fitch, 140 Countries

3. If there is a space, just use it!

In Sections 2, 3, and 4, we have shown that Taiwan has some fiscal space

for expanding either its government deficit or public debt or both,

4

and Section

5 shows that Taiwan's government credit rating is at a good standing. In view of

4

Note that, we are talking about "if there is a space, then use is." This is different from "make a space, and

use it." To make a space, government should reduce expenditure, increase efficiency, increase tax, reduce

government debt or increase government surplus, and reduce public debt. Generally speaking, the space

expands during the economic upturn and shrinks during the economic downturn.

Prime

0~1

High grade

1~4

Upper medium grade

4

ä

7

Lower medium grade

7~10

Speculative 10~13

Highly speculative 13~16

Substantial risks 16~19

Extremely speculative 19~21

In default with little prosp 21~22

In default 23~25

Some country names

#of countries

Credit rating

0

11

12

16

23

19

49

9

0

1

0

10 20 30 40 50 60

Taiwan

4.3, #24

US

Th Tw HK

Gre

Ph Ch UK

Ukr

In Jn Fr

Gr

.

Con .

Ve ,

Re Ind Ma Ko Sgp

10 9 8 7 6 5 4 3 2 1

106