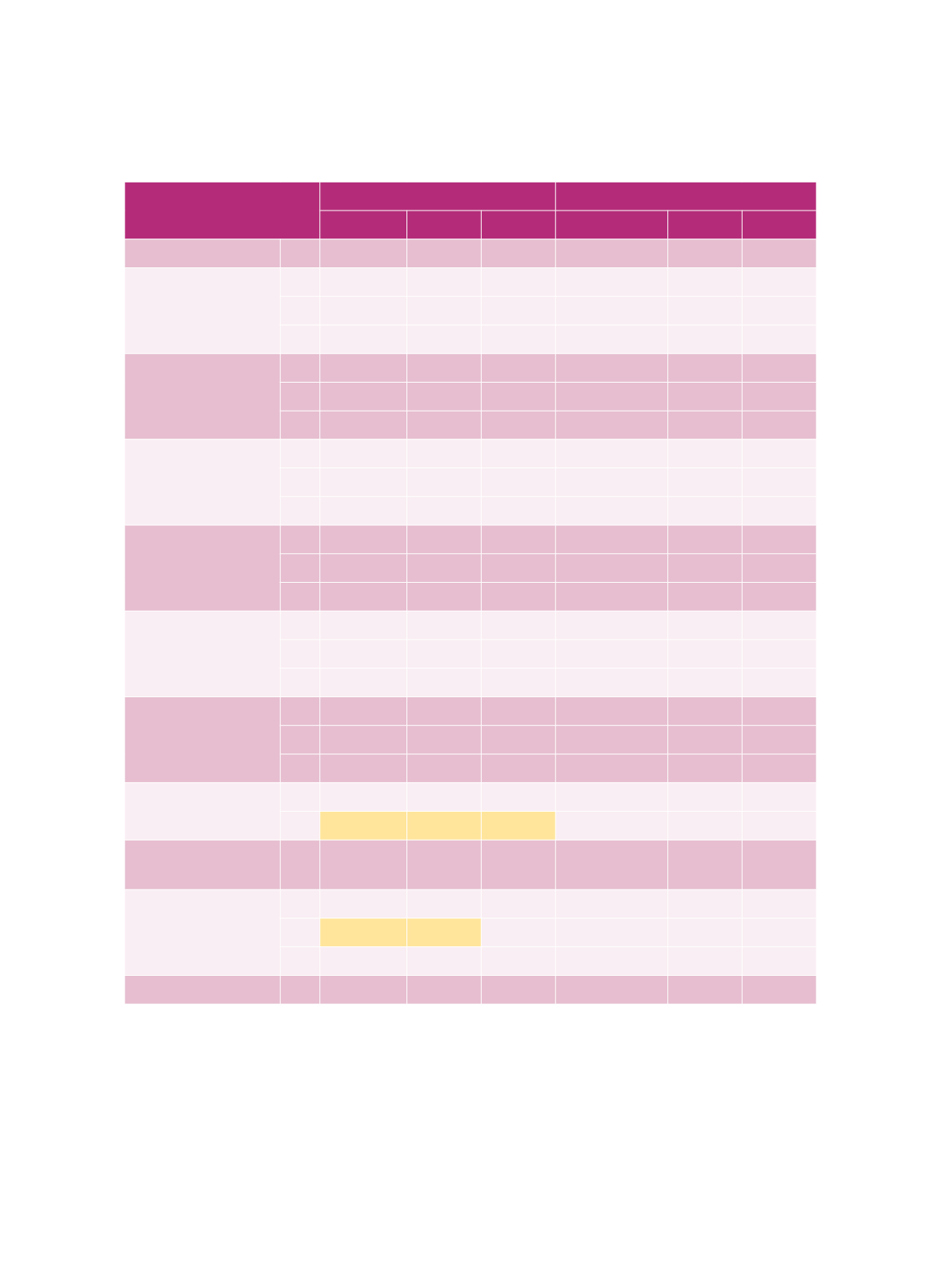

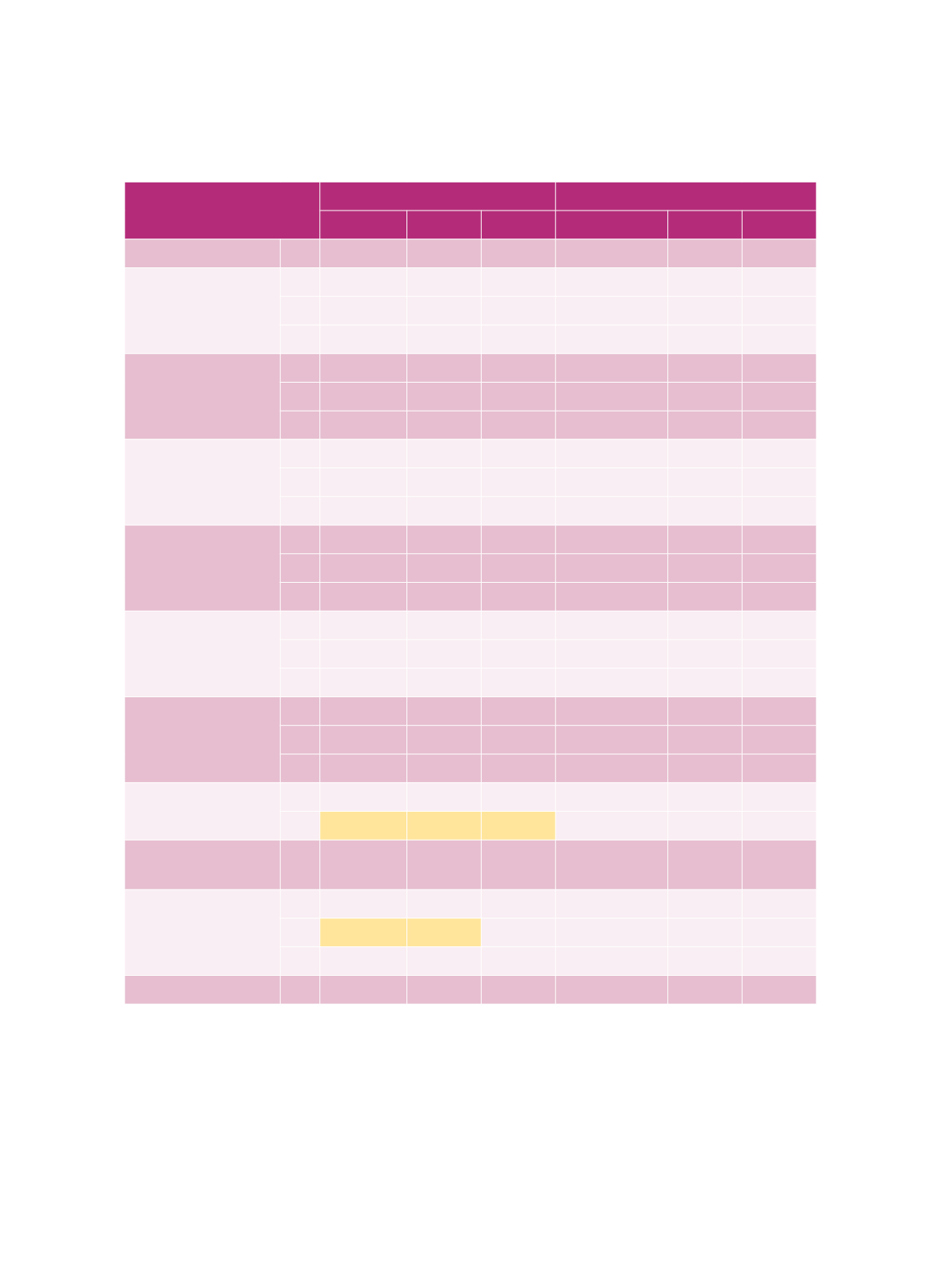

Table C1 Classification of Government Credit Risk for Three Ratings

Category

Grade

Numerical Grade

Moody's S&P Fitch Moody's

S&P Fitch

Prime

1 Aaa

AAA AAA

1

1

1

High grade

c

c

2 Aa1

AA+ AA+

2

2

2

3 Aa2

AA

AA

3

3

3

4 Aa3

AA-

AA-

4

4

4

Upper medium

grade

c

5 A1

A+

A+

5

5

5

6 A2

A

A

6

6

6

7 A3

A-

A-

7

7

7

Lower medium

grade

c

8 Baa1

BBB+ BBB+

8

8

8

9 Baa2

BBB BBB

9

9

9

10 Baa3

BBB-

BBB-

10

10

10

Non-investment

speculative

c

11 Ba1

BB+ BB+

11

11

11

12 Ba2

BB

BB

12

12

12

13 Ba3

BB-

BB-

13

13

13

Highly speculative

c

c

14 B1

B+

B+

14

14

14

15 B2

B

B

15

15

15

16 B3

B-

B-

16

16

16

Substantial risks

c

c

17 Caa1

CCC+ CCC+

17

17

17

18 Caa2

CCC CCC

18

18

18

19 Caa3

CCC-

CCC-

19

19

19

Extremely

speculative

20 Ca

CC CC

20

20

20

21 Ca

CC C

20

20

21

In default with little

prospect of recovery

22 Ca

SD RD

22

22

22

In default

c

c

23 C

D

D

24

24

23

24 C

D

DD

24

24

24

25 C

D

DDD

24

24

25

Not rated

26 WR

NR NR

c c c

Notes: This original list of the grading was downloaded from Expansion (2016). The shaded parts in Categories

21 and 24 are filled by the author.

Sources: Table compiled from Expansion (2016).

114