While the Chinese IPO market suffered in 2015/2016, tides have changed and

recent IPOs have been favorably impacted by the efforts of the China Securities

Regulatory Commission (CSRC) to speed up the approval process as well as

support other exit avenues, such as the recently created NEEQ (National Equities

Exchange and Quotations) or "the New Third Board."

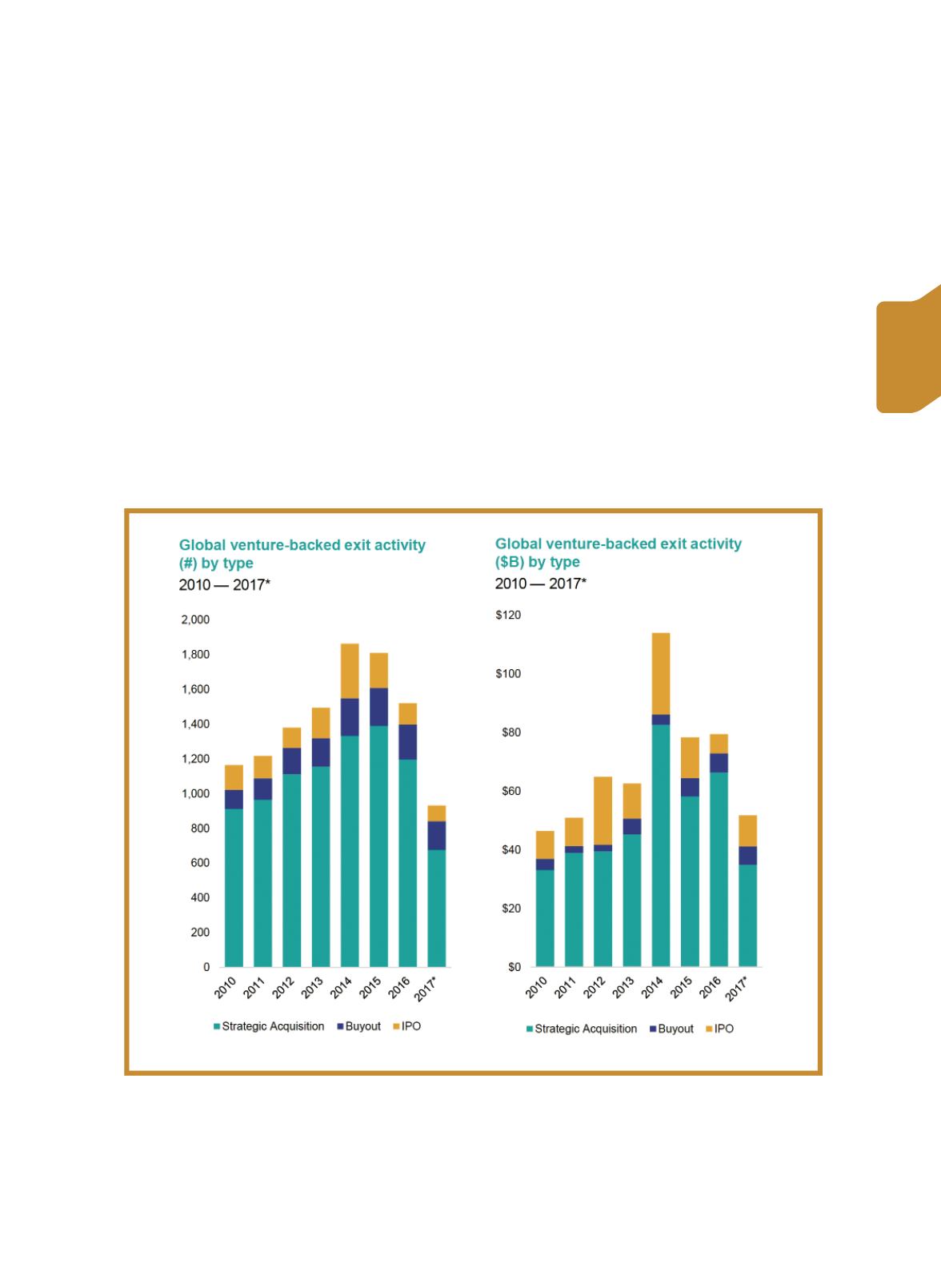

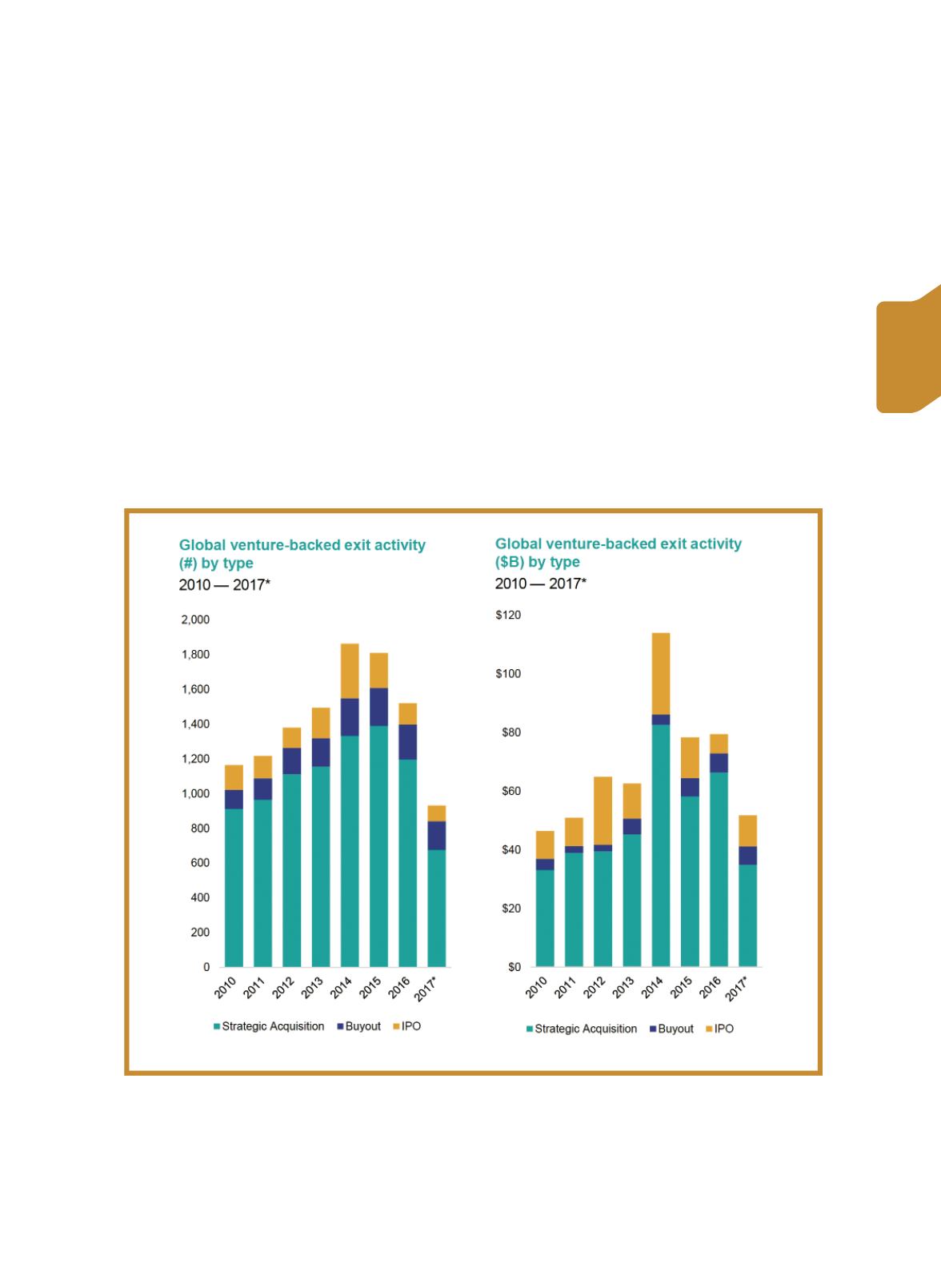

Despite improvement in the overall IPO landscape this year, M&A still

remains the dominate path to liquidity for venture-funded companies, especially

with the growing corporate participation in the VC market (see Figure 6). In 2017,

corporate acquirers continued to drive the majority of M&A transactions, with

With growing strategic/corporate participation in the VC market, M&A remains the dominant path to liquidity.

Sources: "Venture Pulse Q3 2017." KPMG Enterprise, 11 Oct. 2017, page 24.

Figure 6 Mergers and Acquisitions Continue to Dominate VC Exits

41

Taiwan Economic Forum

Volume 15, Number 4

政策

名家

國發

經濟

專題