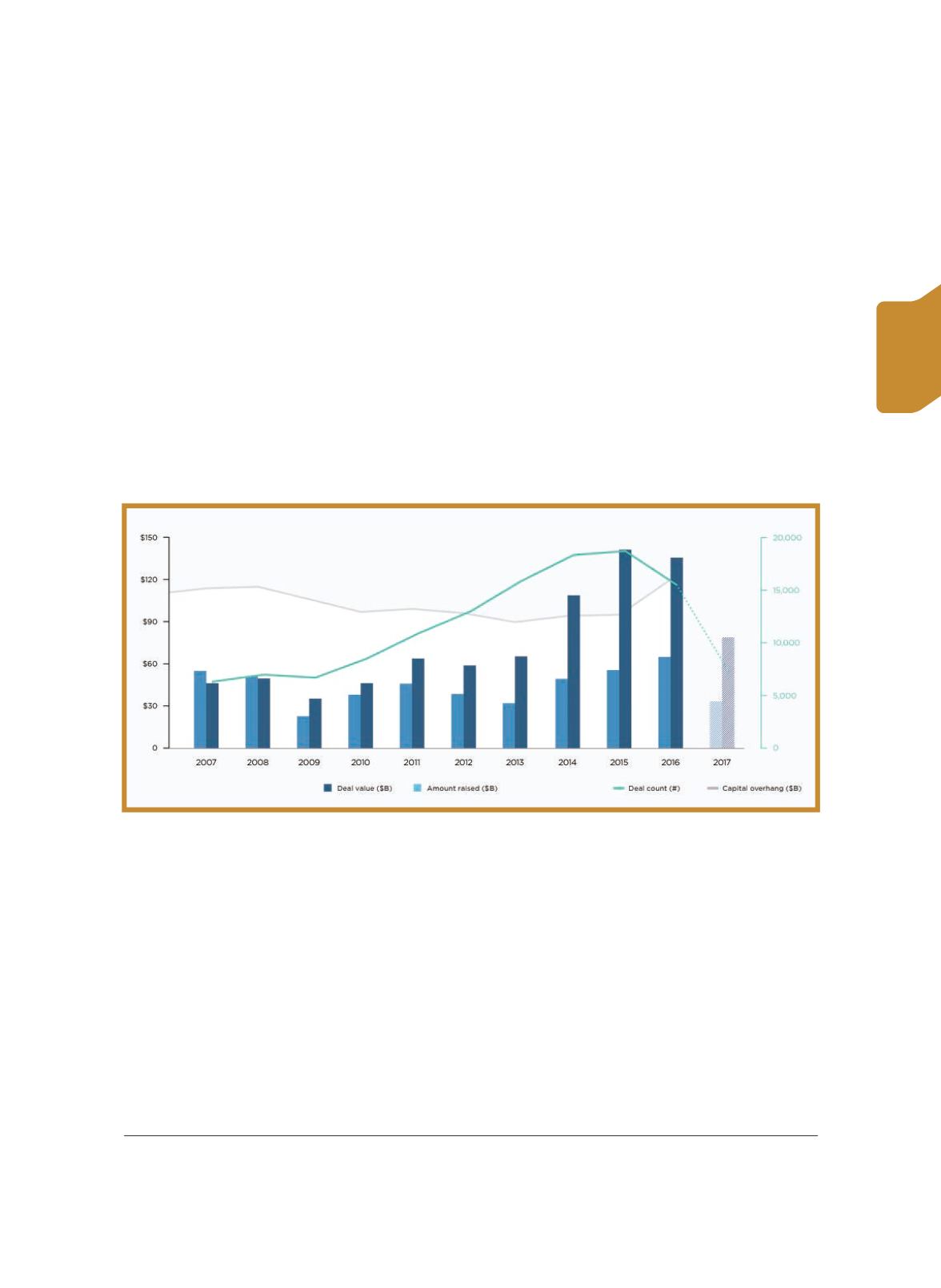

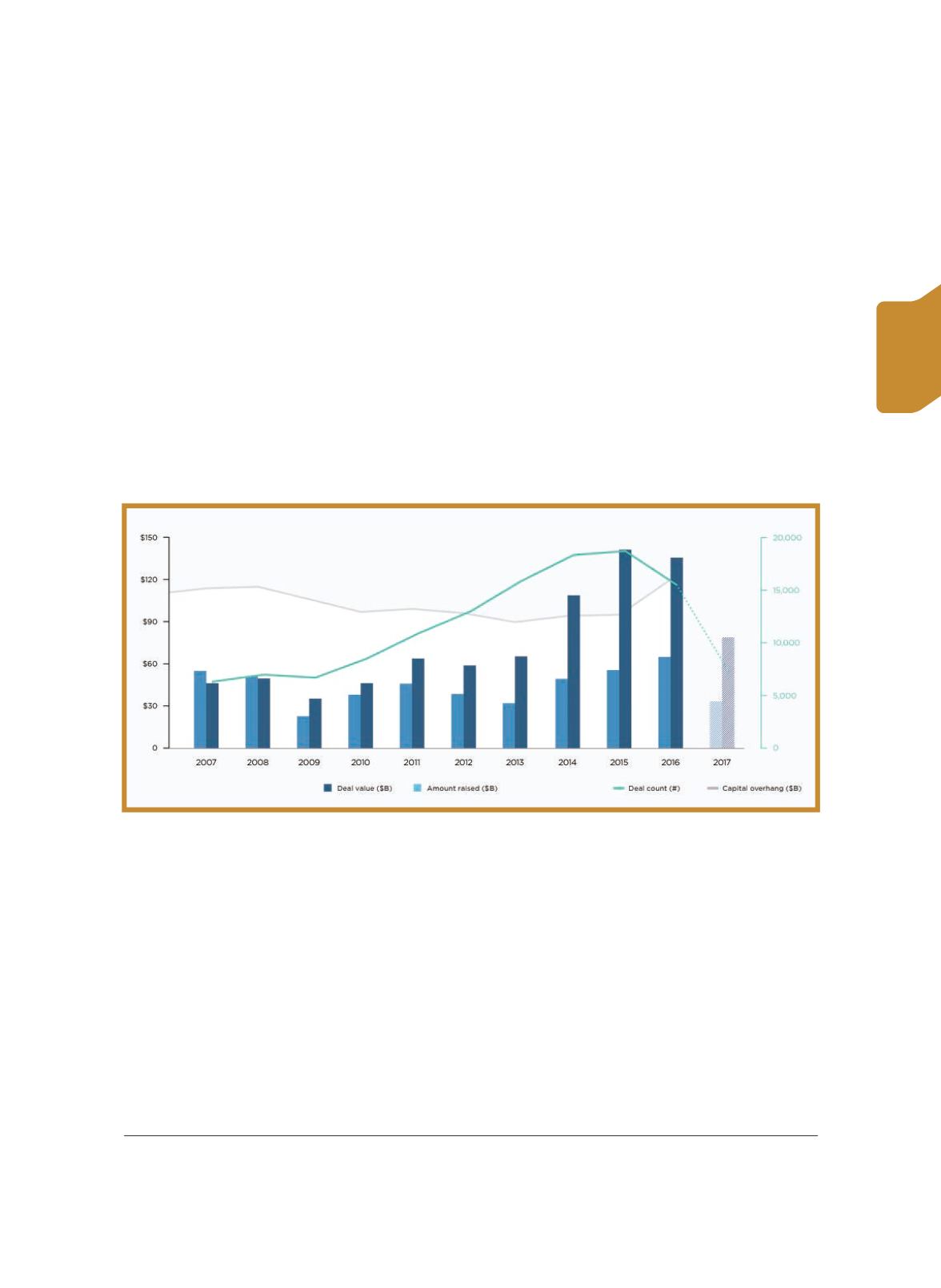

waiting for markets to re-open. As the global economy recovered, investments

followed at a reasonable pace – but not at a velocity sufficient to compete with

pent up demand and competition for deployment of "sidelined" capital.

Eventually capital flooded the global markets in late 2013, resulting in a spike

in both dollars invested and valuations. This movement was further exacerbated

by a trend towards "seed investing", in which VC funds invested small amounts

of capital into numerous companies at the very earliest stages of development.

As a result, deal volume spiked along with valuations and invested capital. These

trends can be seen in the chart below:

Note: A spike in key investment indicators as 'sidelined' capital returned to the global VC market in 2013.

Sources:

Figure 1 A Decade of Venture Capital Investment

Investment velocity started to readjust to healthy levels in late 2016, with

deal activity returning to 2012/2013 levels. Most recently, Q3 2017 (the latest

quarter of available data) saw 2,369 VC financings globally.

1

This is a five-year

low, marking a 6% decline from the previous quarter and a 13% decrease year-

over-year from Q3 2016.

1

"Venture Pulse Q3 2017." KPMG Enterprise, 11 Oct. 2017, page 6.

35

Taiwan Economic Forum

Volume 15, Number 4

政策

名家

國發

經濟

專題