88

IoT is the single largest global trend and investment opportunity available

today, however VC investors should proceed with caution. Surplus capital from

multiple sources flooded this sector early on and it is now facing a substantial

correction. In addition, many consumer-facing IoT startups failed to gain market

traction and/or meet investor expectations, which has in turn resulted in follow-on

rounds of financings being more challenging than anticipated. IoT sector write-

offs are increasing rapidly with some VC funds writing off as much as 50% of their

IoT portfolios.

The following trends are the most viable investment opportunities within the

IoT sector.

• Trend 1 >> IoT in the Smart Home

The beginning of the IoT sector investment boom arguably began when Nest

captured the imagination of consumers and provided a glimpse into the smart

home of the future – and Google's $3.6 billion-dollar acquisition of the company

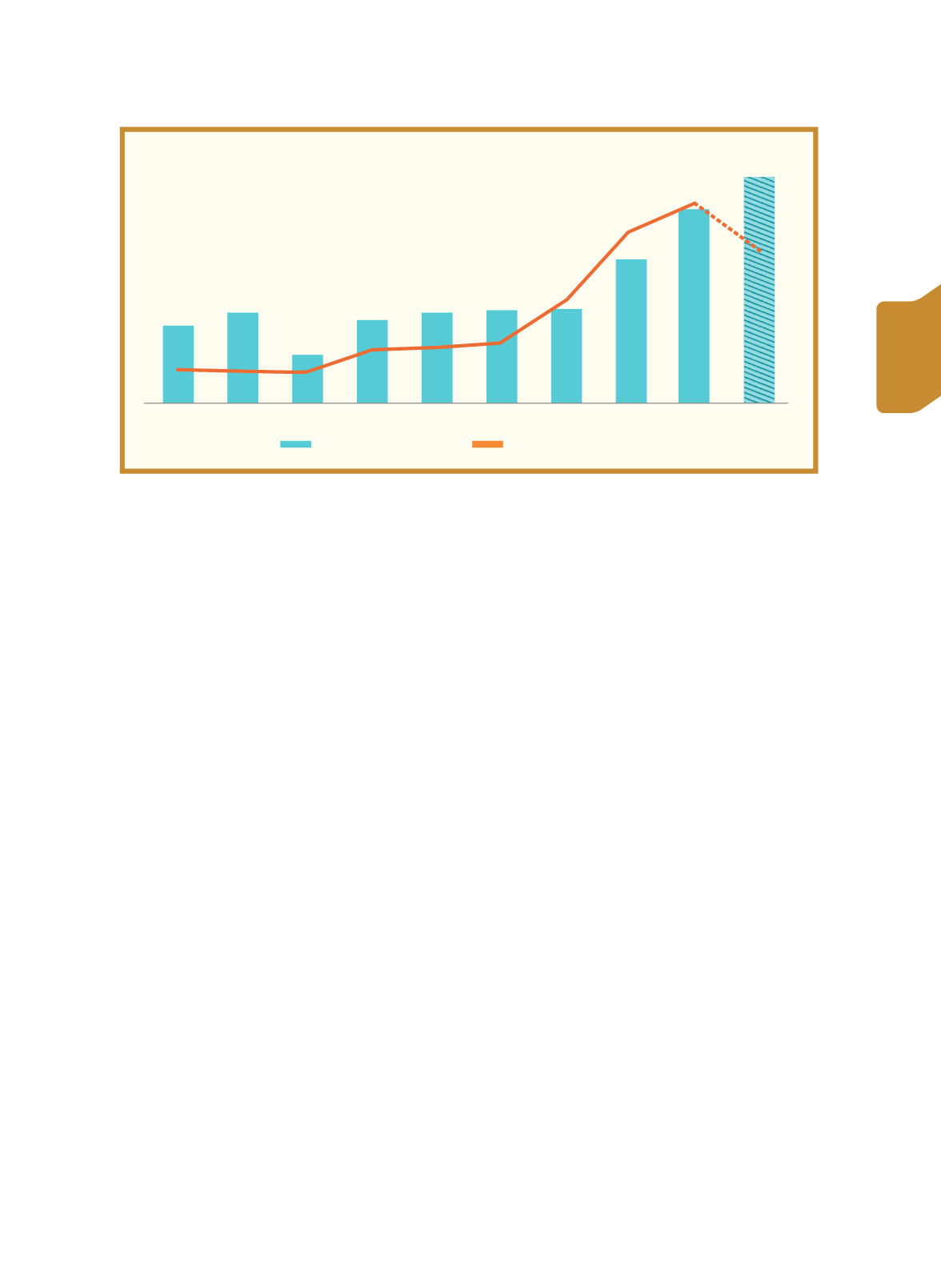

Deal volume decreased in 2016 and 2017, however invested capital continued to increase,

supporting the theory that investors are being more selective and investing more money in fewer

companies.

Sources: Tom, Mikey. "IoT Breakdown: VCs betting billions on the connected world." Pitchbook News, 7 Dec.

2016,

Figure 11 US venture investment in IoT

US venture investment in IoT

ă

456.6M

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016*

ă

530.5M

ă

282.1M

ă

489M

ă

533.8M

ă

542.7M

ă

557.8M

ă

839M

ă

1,13B

ă

1.32B

257

335

288

174

101

94

88

55

54

55

Total Capital Invested

Deal Count

As of 11/30

51

Taiwan Economic Forum

Volume 15, Number 4

政策

名家

國發

經濟

專題