Seed stage deal volumes are the lowest since 2012. However, this may be the result of companies maturing

and moving further into the VC ecosystem rather and an indicator of poor investor confidence.

Sources: "Venture Monitor 3Q 2017." Pitchbook and National Venture Capital Association, 28 Sept. 2017, page 5.

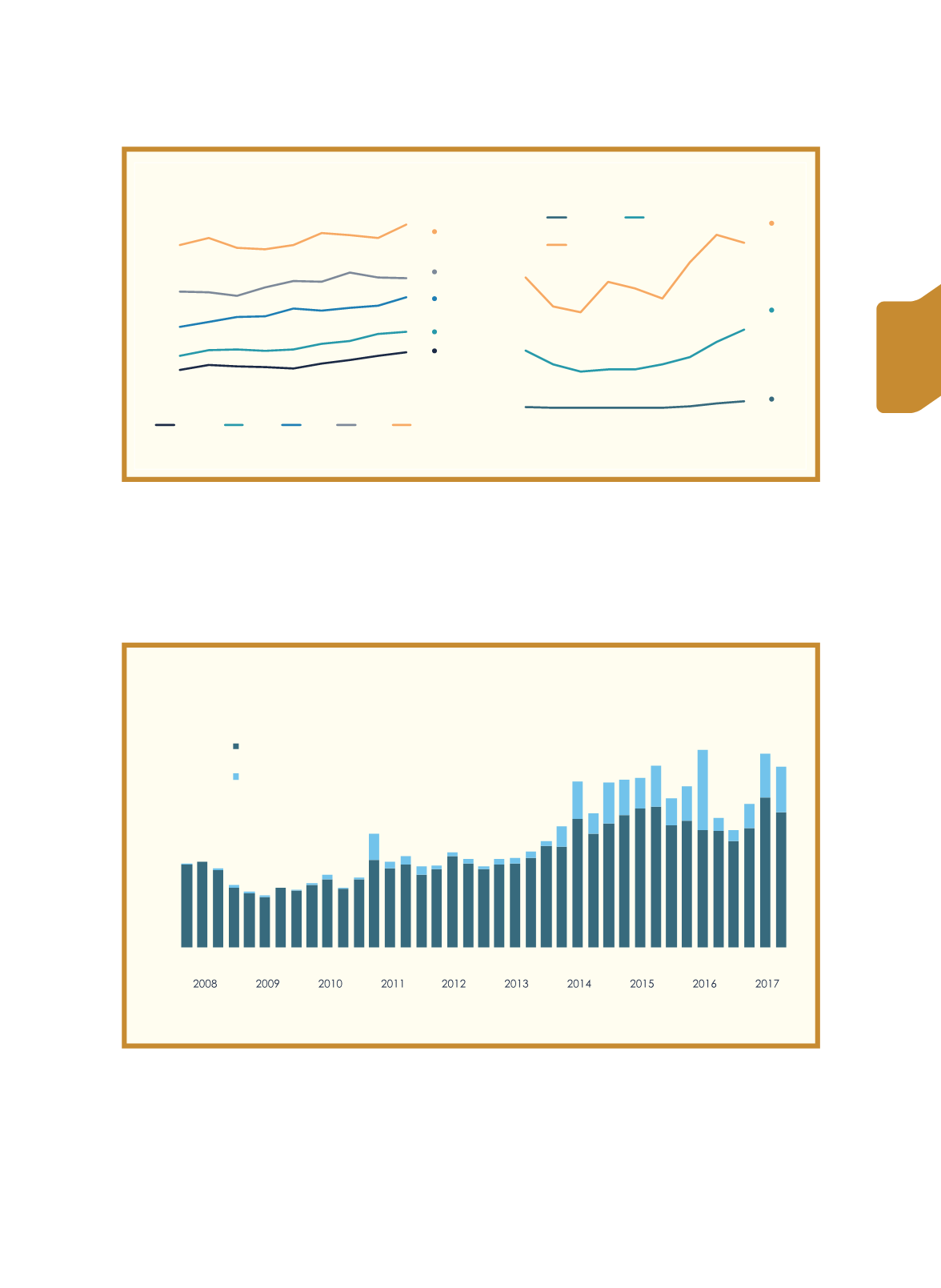

Figure 3 Companies have gotten older

Figure 4 Deals have moved larger

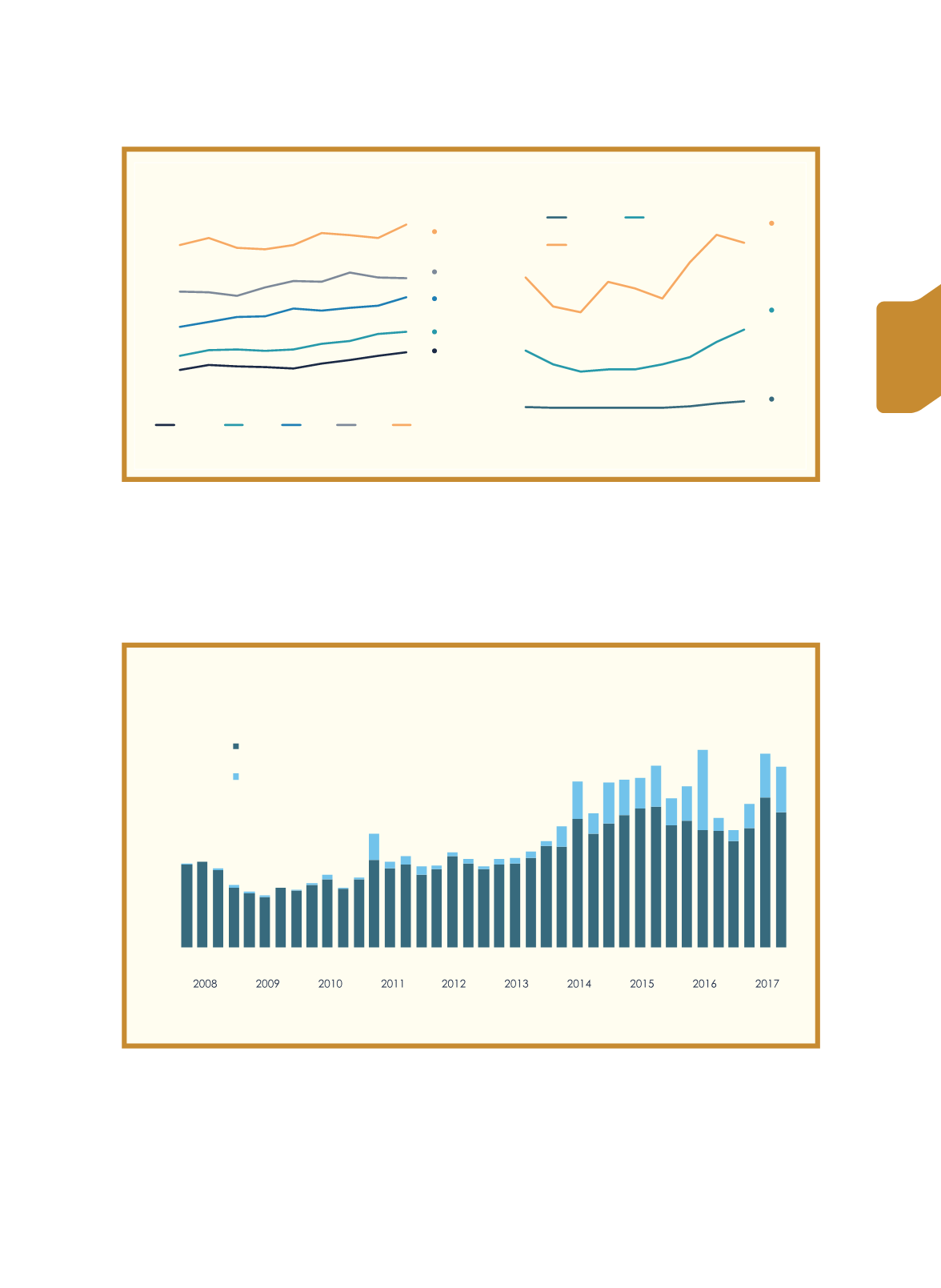

Mega rounds are increasing the aggregate value of deals across the board – another indicator of investor

selectivity.

Sources: "Venture Monitor 3Q 2017." Pitchbook and National Venture Capital Association, 28 Sept. 2017, page 6.

Figure 5 Mega-deals propel US VC investment

$0.9 $1.0

$5.0

$6.1

$10.0

$11.1

$0

$2

$4

$6

$8

$10

$12

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017*

Angel/Seed Early VC

Late VC

PitchBook-NVCA Venture Monitor

*As of 9/30/2017

Median deal size ($M) by stage

2.4

3.4

5.1

6.5

8.6

0

1

2

3

4

5

6

7

8

9

10

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017*

Angel/Seed Series A Series B

Series C Series D+

Median company age (years) by series

PitchBook-NVCA Venture Monitor

*As of 9/30/2017

1Q

Non-unicorn Deal Value

Unicorn Deal Value

$0

$5

$10

$15

$20

$25

Unicorn deals driving growth of aggregate value

Unicorn round deal value versus non-unicorn round deal value ($B)

PitchBook-NVCA Venture Monitor

3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q

39

Taiwan Economic Forum

Volume 15, Number 4

政策

名家

國發

經濟

專題