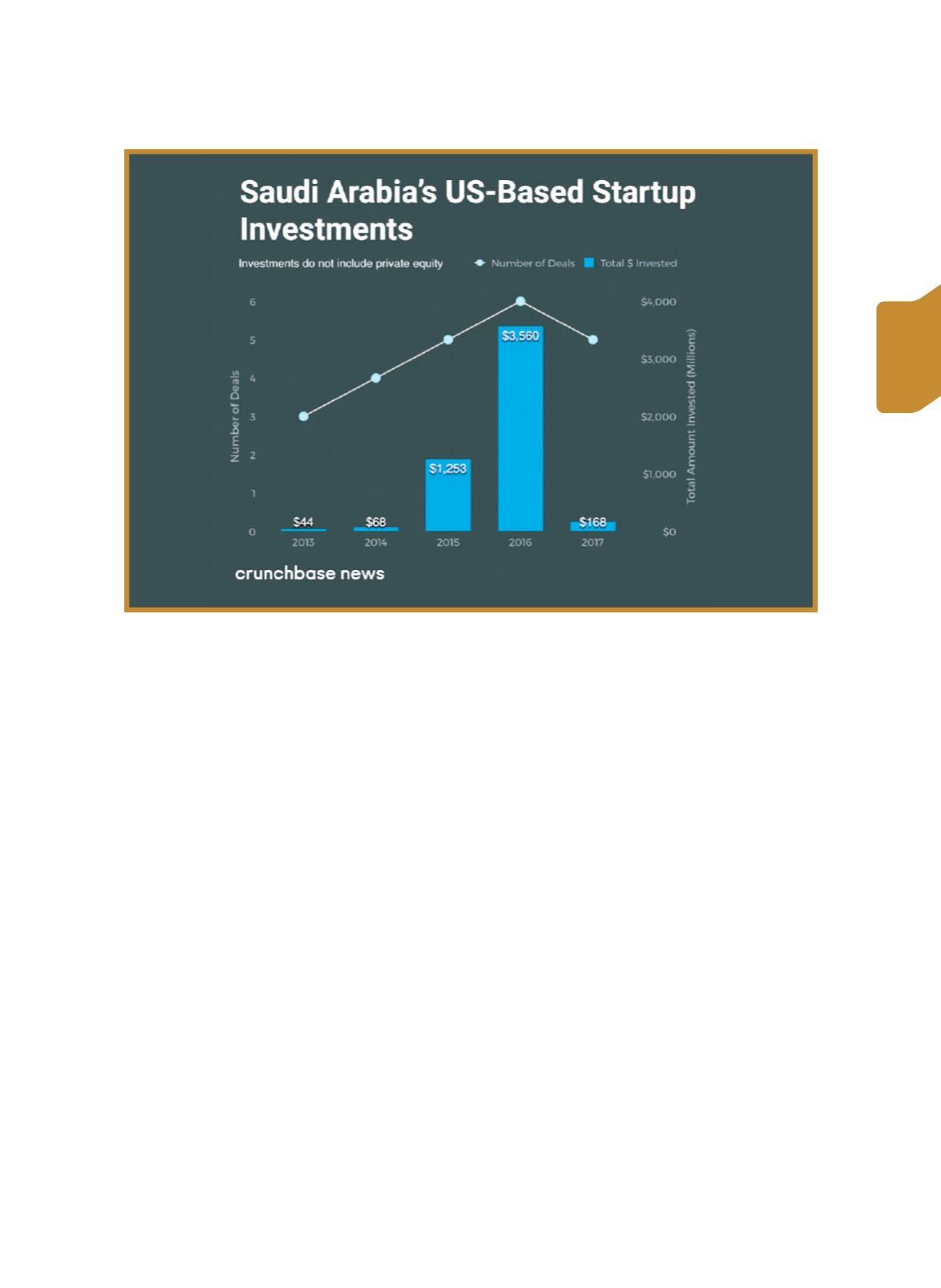

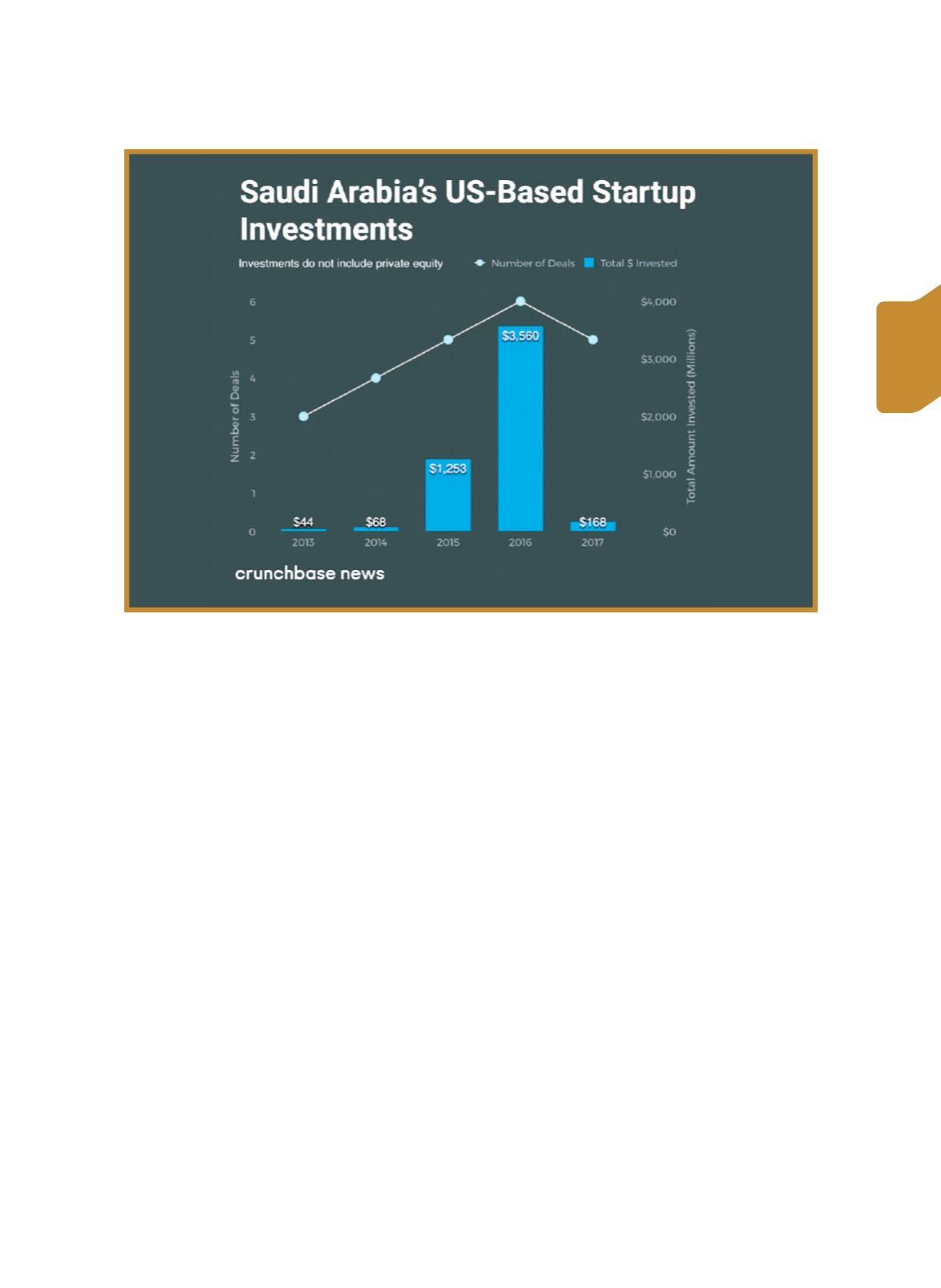

the launch of Saudi capital investing in US deals, 2016 was record breaking on

numerous fronts. The vast majority of known 2016 Saudi VC investment went

into Uber's $3.5 billion Series G raise – in which the sole investor was Saudi

Arabia's Public Investment Fund (PIF). PIF is a $224 billion sovereign wealth

fund led by the Crown Prince, His Royal Highness Prince Mohammed bin Salman

(HRH MBS).

Massive Saudi Arabia investments into US unicorns aren't just notable due

to the size of the rounds. More significantly, the Uber, Lyft, and Snap investments

illustrate the country's departure from what Saudi Arabia knows best: oil and its

respective complements, such as plastics, manufacturing, and chemicals. The

country is also going through an ideological shift, with Crown Prince, HRH MBS,

Saudi Arabian direct investment into US startups is at an all-time high, but still follows typical VC trends of

investing large sums into proven companies.

Sources: Page, Holden. "Saudi Arabian Startup Investment Into US Startups Slows." Crunchbase News, 30

Nov. 2017,

Figure 8 Saudi Arabia VC is at an all-time high

47

Taiwan Economic Forum

Volume 15, Number 4

政策

名家

國發

經濟

專題